Tenant Insurance

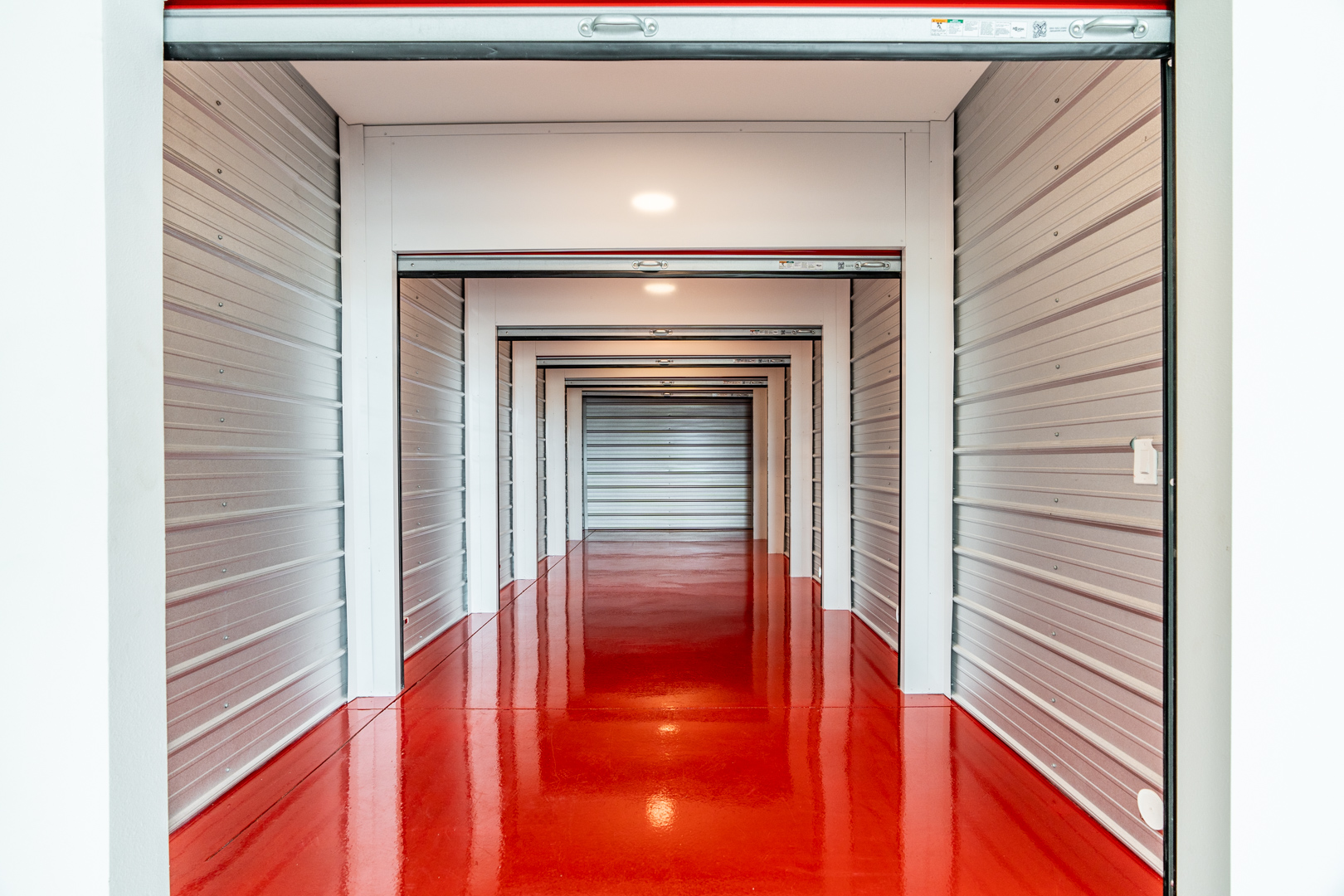

Are you seeking added security and peace of mind for your stored belongings? Look no further than Modern Storage's tenant insurance, provided through StorSmart. Our comprehensive coverage options are designed to safeguard your valuables against unexpected events, ensuring that you can store with confidence.

What is Tenant Insurance?

Tenant insurance is a specialized service tailored for self-storage customers. This insurance provides protection for your possessions in the event of damage, theft, or loss caused by various circumstances, including natural disasters, vandalism, and more.

Coverage Highlights:

Protection Against Natural Disasters: From hurricanes to earthquakes, our tenant insurance ensures that your belongings are covered against the devastating effects of Mother Nature.

Theft and Burglary Coverage: In the unfortunate event of theft or burglary, your items are protected, giving you peace of mind knowing that your valuables are secure.

Fire and Smoke Damage: Whether it's a minor incident or a major fire, our insurance policy provides coverage for damage caused by flames and smoke, helping you recover quickly from unexpected setbacks.

Vandalism and Civil Commotion: Acts of vandalism or civil unrest can occur unexpectedly. With tenant insurance, you're covered against such incidents, minimizing potential financial losses.

Accidental Damage: From accidental water damage to damage caused by falling objects, our insurance policy offers coverage for a wide range of accidental incidents, ensuring that you're prepared for the unexpected.

What's Not Covered?

While our tenant insurance offers extensive protection, it's important to understand what is not covered under the policy, including:

Damage resulting from pre-existing conditions

Mysterious disappearance of items

Overflow of water from a body of water

General wear and tear

Damage due to neglect or intentional acts

Affordable Coverage Options: At Modern Storage, we believe in providing affordable insurance options to suit every budget. With our tenant insurance policy, you can secure coverage for your belongings for as little as $9 a month. We offer flexible coverage options to accommodate your specific needs:

$2,000 coverage for $9 per month

$3,000 coverage for $13 per month

$5,000 coverage for ...

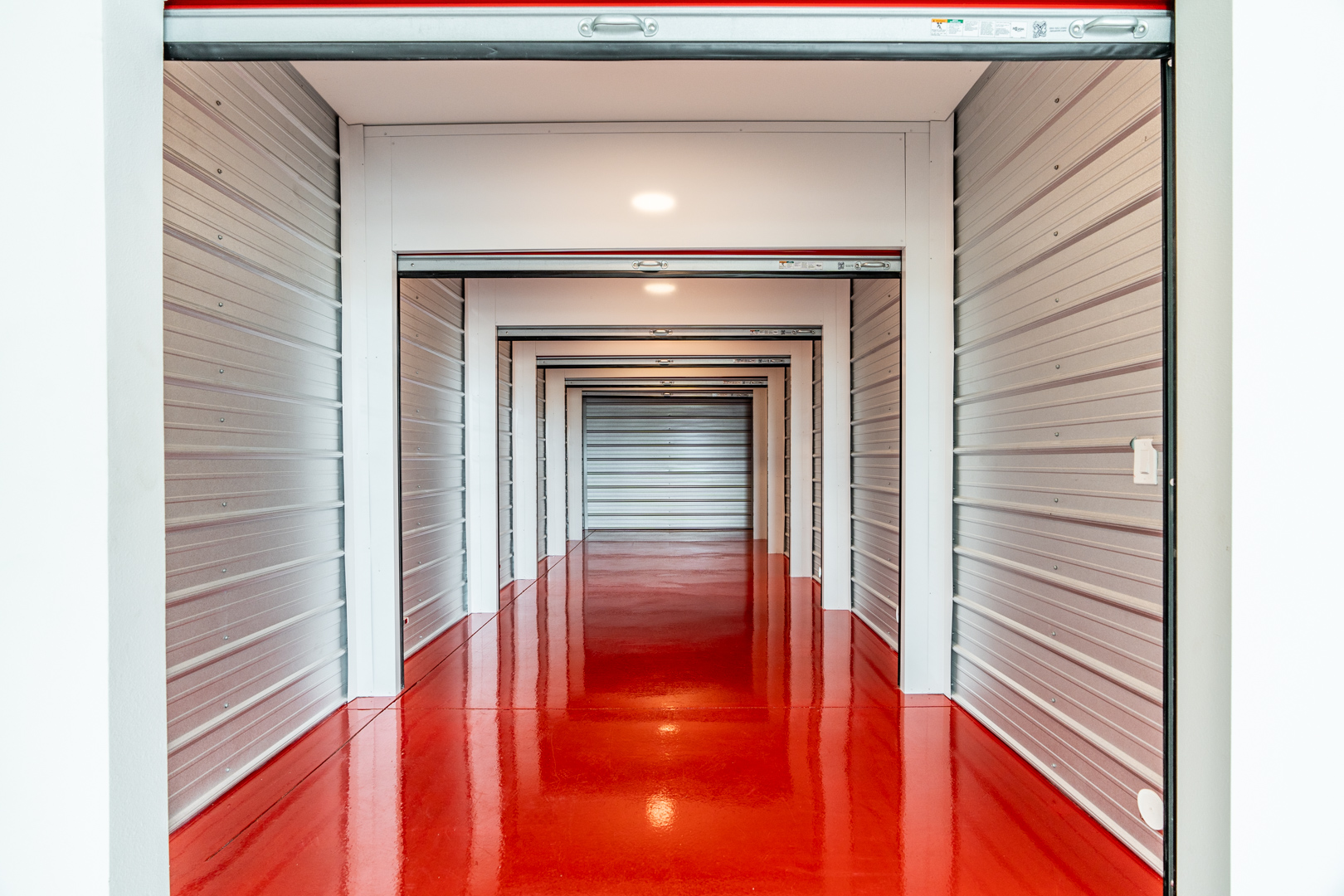

Modern Storage Springdale

April 2nd, 2024